Restaurant Equipment Depreciation Life 2020 . companies can use this method to calculate depreciation for assets whose value derives from the number of. the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. restaurant equipment and their depreciable life. Proceeds before intended use (amendments to ias 16). equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. I purchased refrigerators, freezers, small ovens in november of. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. in may 2020, the board issued property, plant and equipment: calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of.

from www.chegg.com

restaurant equipment and their depreciable life. Proceeds before intended use (amendments to ias 16). in may 2020, the board issued property, plant and equipment: companies can use this method to calculate depreciation for assets whose value derives from the number of. calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. I purchased refrigerators, freezers, small ovens in november of. equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over.

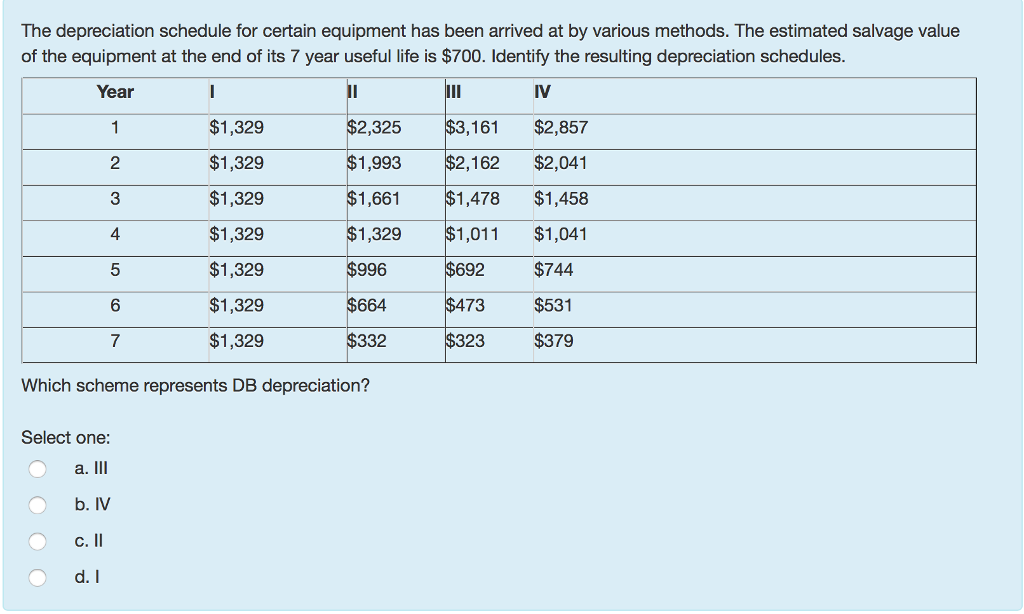

Solved The depreciation schedule for certain equipment has

Restaurant Equipment Depreciation Life 2020 equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. in may 2020, the board issued property, plant and equipment: calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of. restaurant equipment and their depreciable life. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. I purchased refrigerators, freezers, small ovens in november of. companies can use this method to calculate depreciation for assets whose value derives from the number of. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. Proceeds before intended use (amendments to ias 16).

From www.chegg.com

TABLE 113 MACRS Depreciation for Personal Property Restaurant Equipment Depreciation Life 2020 equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. Web. Restaurant Equipment Depreciation Life 2020.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow Restaurant Equipment Depreciation Life 2020 the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of. Proceeds before intended use (amendments to ias 16). depreciable amount is the cost of an asset, or other amount substituted for cost, less its. Restaurant Equipment Depreciation Life 2020.

From elchoroukhost.net

Us Gaap Fixed Asset Useful Life Table Elcho Table Restaurant Equipment Depreciation Life 2020 equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. Web. Restaurant Equipment Depreciation Life 2020.

From www.sampleschedule.com

27+ Sample Depreciation Schedule sample schedule Restaurant Equipment Depreciation Life 2020 when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of. Proceeds before intended use (amendments to ias 16). companies can use this method to calculate depreciation for assets whose value derives from the. Restaurant Equipment Depreciation Life 2020.

From brokeasshome.com

Irs Depreciation Tables 2018 Restaurant Equipment Depreciation Life 2020 depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of. equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. in may 2020, the. Restaurant Equipment Depreciation Life 2020.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Restaurant Equipment Depreciation Life 2020 in may 2020, the board issued property, plant and equipment: restaurant equipment and their depreciable life. companies can use this method to calculate depreciation for assets whose value derives from the number of. I purchased refrigerators, freezers, small ovens in november of. the federal cares act of 2020 has made the depreciation rules more favorable by. Restaurant Equipment Depreciation Life 2020.

From lessonmagicramon.z21.web.core.windows.net

Depreciation Worksheet Excel Template Restaurant Equipment Depreciation Life 2020 restaurant equipment and their depreciable life. the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. when a restaurant constructs a depreciable asset, all direct costs are included in. Restaurant Equipment Depreciation Life 2020.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Restaurant Equipment Depreciation Life 2020 calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of. companies can use this method to calculate depreciation for assets whose value derives from the number of. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. the federal cares act of 2020. Restaurant Equipment Depreciation Life 2020.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Restaurant Equipment Depreciation Life 2020 companies can use this method to calculate depreciation for assets whose value derives from the number of. I purchased refrigerators, freezers, small ovens in november of. depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful. Restaurant Equipment Depreciation Life 2020.

From brokeasshome.com

Gaap Depreciation Life Table Restaurant Equipment Depreciation Life 2020 in may 2020, the board issued property, plant and equipment: the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. I purchased refrigerators, freezers, small ovens in november of. Proceeds. Restaurant Equipment Depreciation Life 2020.

From turexusa.com

How to Calculate Restaurant Equipment Depreciation TUREX Restaurant Equipment Depreciation Life 2020 restaurant equipment and their depreciable life. the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. companies can use this method to calculate depreciation for assets whose value derives from the number of. when a restaurant constructs a depreciable asset, all direct costs are included in the total. Restaurant Equipment Depreciation Life 2020.

From www.scheduletemplate.org

9 Free Depreciation Schedule Templates in MS Word and MS Excel Restaurant Equipment Depreciation Life 2020 I purchased refrigerators, freezers, small ovens in november of. equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. depreciable amount is the cost of an asset, or other. Restaurant Equipment Depreciation Life 2020.

From maxinecieran.blogspot.com

Restaurant equipment depreciation calculator MaxineCieran Restaurant Equipment Depreciation Life 2020 the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. restaurant equipment and their depreciable life. in may 2020, the board issued property, plant and equipment: equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. Proceeds before intended. Restaurant Equipment Depreciation Life 2020.

From printablelibfester.z13.web.core.windows.net

Depreciation Table Excel Template Restaurant Equipment Depreciation Life 2020 companies can use this method to calculate depreciation for assets whose value derives from the number of. the federal cares act of 2020 has made the depreciation rules more favorable by creating possible tax savings. Proceeds before intended use (amendments to ias 16). I purchased refrigerators, freezers, small ovens in november of. restaurant equipment and their depreciable. Restaurant Equipment Depreciation Life 2020.

From noemystacey.blogspot.com

Restaurant equipment depreciation calculator NoemyStacey Restaurant Equipment Depreciation Life 2020 equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. Proceeds before intended use (amendments to ias 16). restaurant equipment and their depreciable life. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. I purchased refrigerators, freezers, small. Restaurant Equipment Depreciation Life 2020.

From www.micoope.com.gt

Depreciation Schedule Guide, Example, How To Create, 42 OFF Restaurant Equipment Depreciation Life 2020 Proceeds before intended use (amendments to ias 16). depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. equipment depreciation is an accounting method used to measure the gradual decrease. Restaurant Equipment Depreciation Life 2020.

From willsanellis.blogspot.com

Heavy equipment depreciation calculator WillsanEllis Restaurant Equipment Depreciation Life 2020 companies can use this method to calculate depreciation for assets whose value derives from the number of. restaurant equipment and their depreciable life. I purchased refrigerators, freezers, small ovens in november of. calculating restaurant equipment depreciation requires knowing the cost of the equipment, the useful life of. in may 2020, the board issued property, plant and. Restaurant Equipment Depreciation Life 2020.

From printableformsfree.com

Form 02 01 Refund Of Accumulated Contributions Printable Printable Restaurant Equipment Depreciation Life 2020 when a restaurant constructs a depreciable asset, all direct costs are included in the total cost of the asset. companies can use this method to calculate depreciation for assets whose value derives from the number of. equipment depreciation is an accounting method used to measure the gradual decrease in the value of your assets over. Proceeds before. Restaurant Equipment Depreciation Life 2020.