Utah Tax Credit For Disabled Child . utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. The dependent is 21 years of age. to qualify as a dependent child with a disability, all of the following conditions must be met: contribute to the fund. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. It also makes utah the 13th state with our. Help us provide educational choice to students across utah.

from www.dochub.com

contribute to the fund. It also makes utah the 13th state with our. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. to qualify as a dependent child with a disability, all of the following conditions must be met: salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. The dependent is 21 years of age. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. Help us provide educational choice to students across utah.

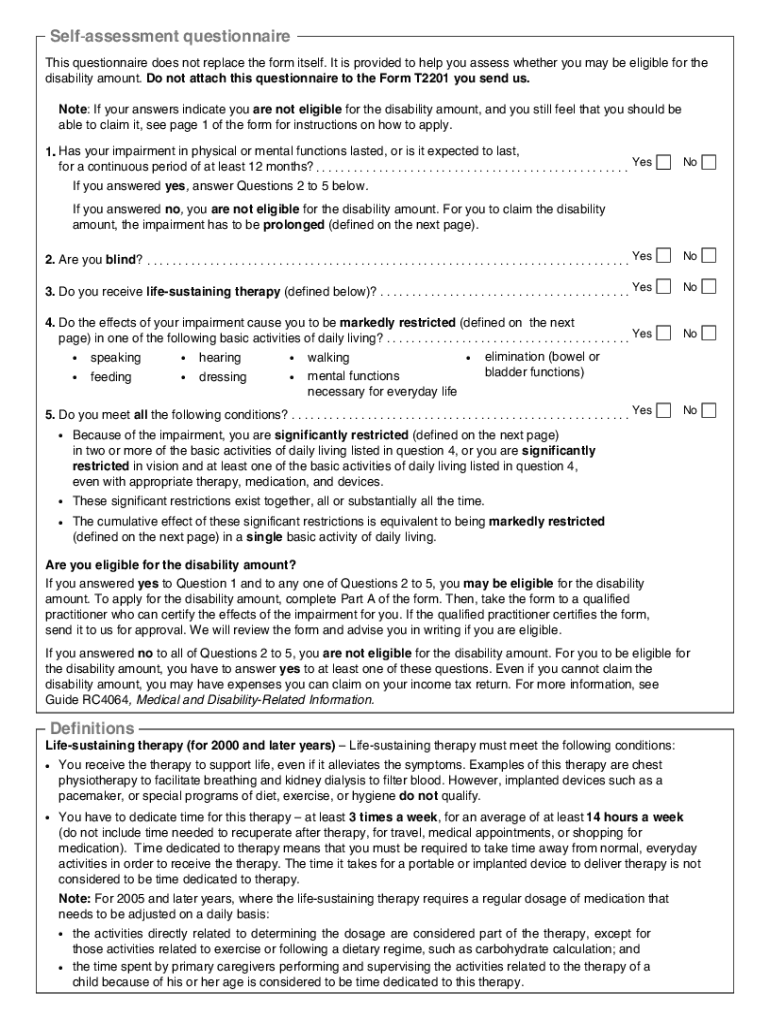

Disability tax credit form pdf Fill out & sign online DocHub

Utah Tax Credit For Disabled Child Help us provide educational choice to students across utah. to qualify as a dependent child with a disability, all of the following conditions must be met: apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. Help us provide educational choice to students across utah. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. The dependent is 21 years of age. contribute to the fund. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. It also makes utah the 13th state with our.

From cwccareers.in

3600 Child Tax Credit 2024 Know How to Claim, Payment Date & Eligibility Utah Tax Credit For Disabled Child contribute to the fund. Help us provide educational choice to students across utah. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. utah’s narrowly. Utah Tax Credit For Disabled Child.

From filingtaxes.ca

10 Benefits of Getting Approved for the Disability Tax Credit and RDSP Utah Tax Credit For Disabled Child Help us provide educational choice to students across utah. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. It also makes utah the 13th state with our. The. Utah Tax Credit For Disabled Child.

From murdochnina.blogspot.com

20+ Child Support Calculator Utah MurdochNina Utah Tax Credit For Disabled Child apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. The dependent is 21 years of age. to qualify as a dependent child with a disability,. Utah Tax Credit For Disabled Child.

From www.squire.com

Advance Child Tax Credit Payments Coming to a Bank Account or Mailbox Utah Tax Credit For Disabled Child The dependent is 21 years of age. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. It also makes utah the 13th state with our. Help us. Utah Tax Credit For Disabled Child.

From www.autismbc.ca

Disability Tax Credit (DTC) — Autism Q & A, Blog, Caregivers, Funding Utah Tax Credit For Disabled Child contribute to the fund. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. salt lake city ( abc4) — with the passage of hb 170 in. Utah Tax Credit For Disabled Child.

From taxwalls.blogspot.com

How Much Is The Tax Credit For Disabled Child Tax Walls Utah Tax Credit For Disabled Child utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. to qualify as a dependent child with a disability, all of the following conditions must be met: The dependent is 21 years of age. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater. Utah Tax Credit For Disabled Child.

From www.youtube.com

3,600 Child Tax Credit 2021 250 300 Monthly Payment. How much you Utah Tax Credit For Disabled Child The dependent is 21 years of age. It also makes utah the 13th state with our. contribute to the fund. to qualify as a dependent child with a disability, all of the following conditions must be met: Help us provide educational choice to students across utah. apportionable nonrefundable credits can reduce your income tax to zero, but. Utah Tax Credit For Disabled Child.

From accessiblewallet.com

Disability Tax Credit (EasytoUnderstand Guide with life examples) Utah Tax Credit For Disabled Child The dependent is 21 years of age. contribute to the fund. It also makes utah the 13th state with our. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the. Utah Tax Credit For Disabled Child.

From www.cbc.ca

COVID19 puts disability tax credit reform on back burner CBC News Utah Tax Credit For Disabled Child utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. It also makes utah the 13th state with our. Help us provide educational choice to students across utah. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families.. Utah Tax Credit For Disabled Child.

From themomkind.com

Understanding the Disabled Child Tax Credit & the Financial Impact Utah Tax Credit For Disabled Child Help us provide educational choice to students across utah. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. It also makes utah the 13th state with our. to qualify as a dependent child with a disability, all of the following conditions must be met: utah’s. Utah Tax Credit For Disabled Child.

From taxvisors.ca

Maximize Family Tax Credits Childcare, Education & Disability Utah Tax Credit For Disabled Child to qualify as a dependent child with a disability, all of the following conditions must be met: contribute to the fund. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater. Utah Tax Credit For Disabled Child.

From www.investopedia.com

Tax Credits Utah Tax Credit For Disabled Child to qualify as a dependent child with a disability, all of the following conditions must be met: It also makes utah the 13th state with our. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. apportionable nonrefundable credits can reduce your income tax to zero, but any. Utah Tax Credit For Disabled Child.

From www.thales-ld.com

Financial Boost For Disabled Persons Through The Federal Tax Program Utah Tax Credit For Disabled Child to qualify as a dependent child with a disability, all of the following conditions must be met: salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah families. The dependent is 21 years of age. apportionable nonrefundable credits can reduce your income tax to zero, but any. Utah Tax Credit For Disabled Child.

From wnynewsnow.com

How The Expanded Child Tax Credit Payments Work WNY News Now Utah Tax Credit For Disabled Child contribute to the fund. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. The dependent is 21 years of age. Help us provide educational choice to students. Utah Tax Credit For Disabled Child.

From nightingalemedical.ca

Disability Tax Credit for People Living With A Ostomy Nightingale Utah Tax Credit For Disabled Child It also makes utah the 13th state with our. Help us provide educational choice to students across utah. utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. to qualify as a dependent child with a disability, all of the following conditions must be met: contribute to the. Utah Tax Credit For Disabled Child.

From www.formsbank.com

Fillable Form Tc40d Dependent With A Disability Exemption Utah Utah Tax Credit For Disabled Child to qualify as a dependent child with a disability, all of the following conditions must be met: The dependent is 21 years of age. It also makes utah the 13th state with our. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than the tax will not be. contribute to the fund.. Utah Tax Credit For Disabled Child.

From www.dochub.com

Disability tax credit form pdf Fill out & sign online DocHub Utah Tax Credit For Disabled Child contribute to the fund. to qualify as a dependent child with a disability, all of the following conditions must be met: The dependent is 21 years of age. Help us provide educational choice to students across utah. salt lake city ( abc4) — with the passage of hb 170 in the state legislature last week, some utah. Utah Tax Credit For Disabled Child.

From fabalabse.com

What is new disability tax credit? Leia aqui Is there a federal tax Utah Tax Credit For Disabled Child utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each. to qualify as a dependent child with a disability, all of the following conditions must be met: The dependent is 21 years of age. apportionable nonrefundable credits can reduce your income tax to zero, but any credit greater. Utah Tax Credit For Disabled Child.